#1 The Capital Gains Tax Advisory Firm

- You can get your free consultation today if you generate over 800K in Capital Gains Tax.

- We can help you reduce your Capital Gains Tax Obligation.

+30 Years

of Experience

100%

Audit Proof Solutions

+1,000

Clients Helped in 2023

800K

Minimum Taxable Income Required

30 +

Years

Experience

Why Choose Us

Benefits of working with Wilson hand

Our tax advisors understand the stress of tax season and a large tax obligation that makes you feel like taxes have significantly reduced your income. We offer multiple tax mitigation strategies that can effectively reduce your tax liability through a straightforward, time-tested approach.

- Reduce Your Tax Obligation

- Free Consultation with a Tax Advisor

- Custom Solutions Based on Your Situation

- Increase Your Net Gain

- Advanced Options

Wilson Hand offers exclusive tax mitigation products to help individuals and business owners reduce their taxable income. We do not advertise our products directly to the client; instead, we align with professionals and small firms to add additional strategies to their client solutions portfolio.

Learn More About Wilson Hand

Our mission is to power the future

Wilson Hand focuses on increasing the amount of capital in the private economy. We believe that the producers of assets and value are the best stewards of those assets and value. These individuals should have authority and control over how they reinvest the value they create. Wilson Hand can empower these individuals to grow their businesses, affect change in their community, and build a financial estate for their beneficiaries by having a program that helps keep more capital in the private economy.

Get Started Today

Contact Wilson Hand

Wilson Hand partners with Financial Advisors, Wealth Managers/ Advisors, Financial Consultants, Tax Strategists, and Estate Attorneys with a client base of business owners and individuals with a high six-figure taxable income that will benefit from our tax products. Wilson Hand and our partners ensure that highly compensated individuals and business owners feel confident participating in our tax mitigation strategies.

Innovative Solutions:

Embracing change, we provide creative and adaptive solutions, navigating the evolving tax landscape with finesse.

How Can Wilson Hand Help You

Client Results

Jamie G.

- Participation Cost: $120,000

- Tax Rate: 42%

- Deduction: $600,000

- Net Gain: $132,000

Andrew S.

- Participation Cost: $72,000

- Tax Rate: 35%

- Deduction: $360,000

- Net Gain: $126,000

Perri M.

- Participation Cost: $200,000

- Tax Rate: 37%

- Deduction: $1,000,000

- Net Gain: $170,000

Powerful Team

Key Partners

Jarum Stone

Relationship Manager

John Ryan

Relationship Manager

Nathon Barton

Relationship Manager

Andrej Kandus

Relationship Manager

Wilson Hand Values

Integrity & Transparency: We uphold utmost honesty and clarity in every legal endeavor, demystifying complex processes for our clients.

Client-Centric Advocacy: At the heart of our operations lies an unwavering commitment to prioritizing and fiercely defending our clients’ interests.

Innovative Solutions: Embracing change, we provide creative and adaptive solutions, navigating the evolving tax landscape with finesse.

Contact Wilson Hand today to learn more about how we can help your company succeed.

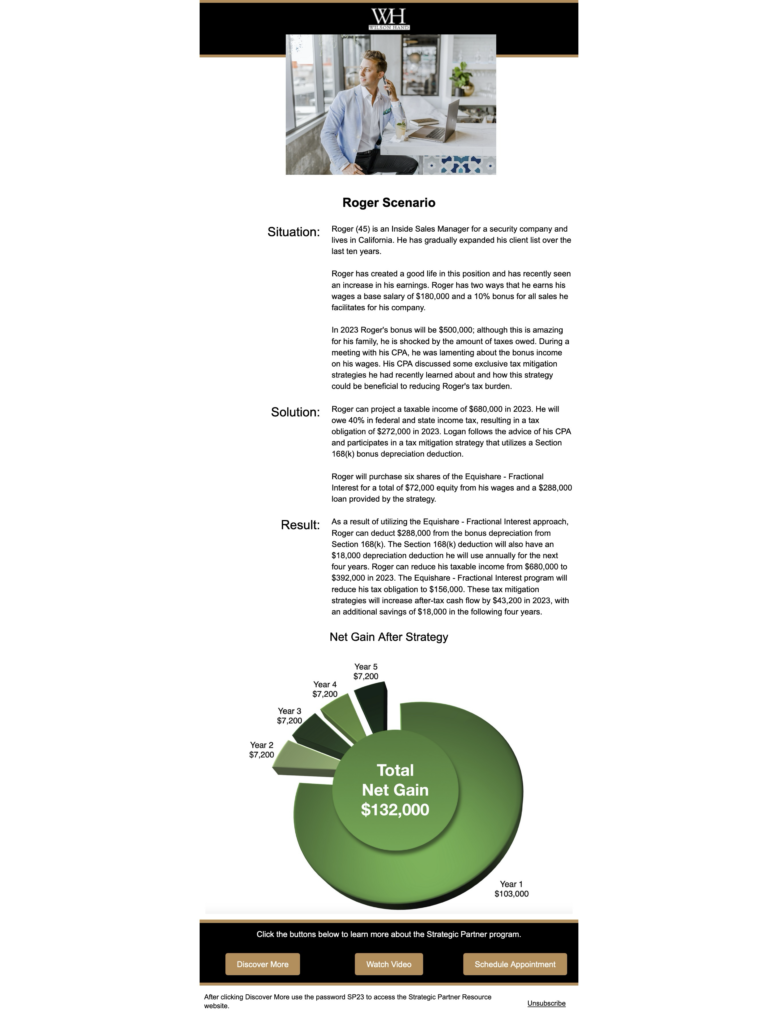

Case Studies

Click a case study below to explore how our tax strategies have helped clients save thousands.

Locations

Wyoming

960 Alpine Lane

#4

Jackson Hole, WY 83001

Singapore

111 North Bridge Road

#24-2

Peninsula Plaza, Singapore 179089

Utah

250 East 200 South

#330

Salt Lake City, UT 84111

Arizona

4254 N Brown Ave

#108

Scottsdale, AZ 85251

Practice Areas

Tax Planning

Estate Planning

Capital Markets

Corporate Finance

Securities

Mergers and Acquisition