-

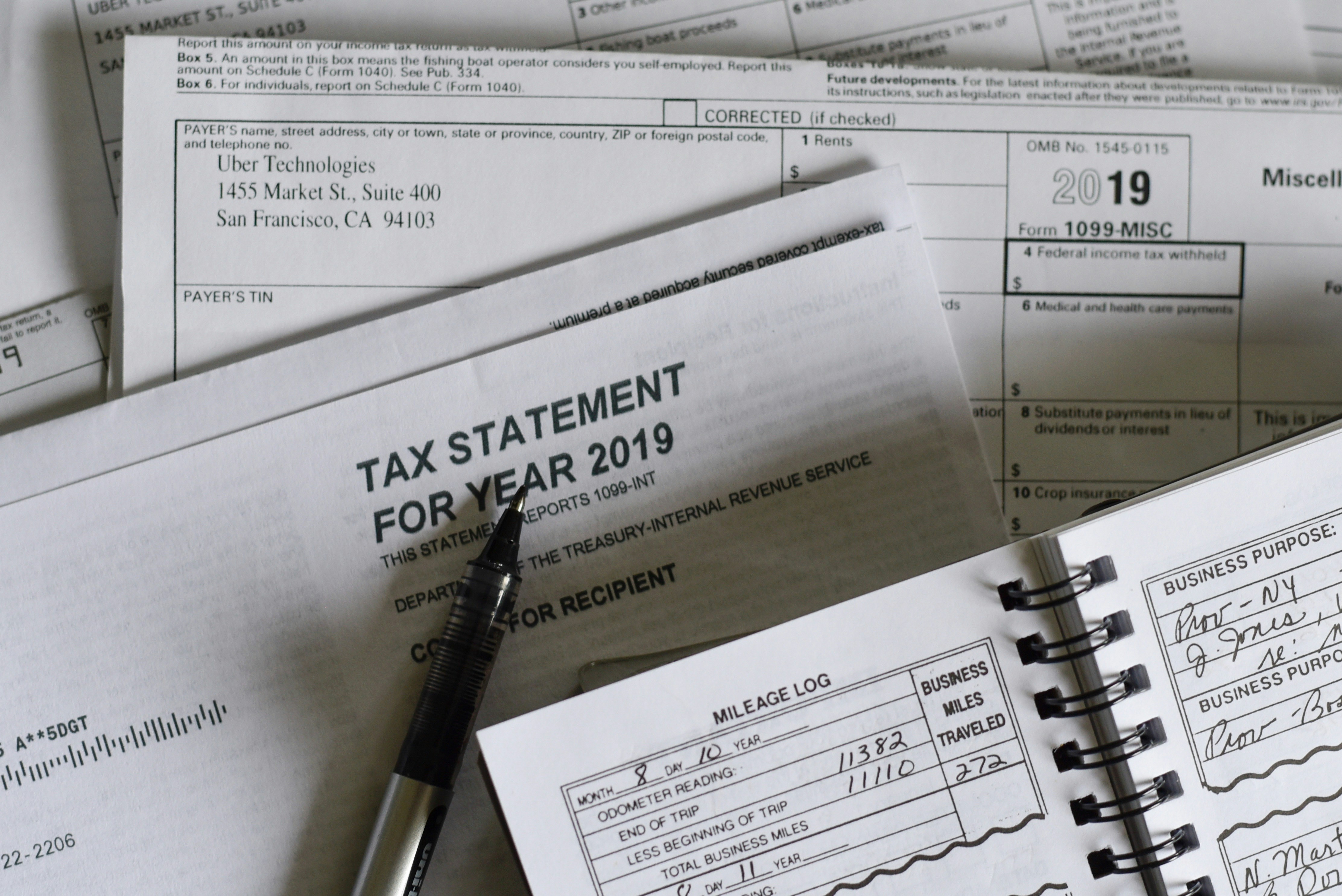

Unlocking Tax Savings with Special Allocations: A Guide for Individuals and Business Owners

Tax planning is a crucial part of wealth management, especially for high-income individuals and business

-

The Importance of Tax Planning – Strategies to Reduce Your Tax Burden

In this world nothing can be said to be certain, except death and taxes. –

-

Are You Close to Retirement? Here’s What You Need to Know

We all dream of retiring and enjoying the freedom we’ve worked so hard for. But

-

Why Tax Planning Now Will Set You Up for Success in 2025

As the new year begins, many of us focus on resolutions to improve our lives—losing

-

Exploring Tax Programs at Wilson Hand: Maximize Deductions, Minimize Liabilities

At Wilson Hand, we specialize in designing tax strategies that help our clients reduce their

-

Year-End Tax Planning: Take Control of Your Tax Obligation Now

High-income earners know the importance of planning when it comes to their finances. This planning

-

What are Capital Assets and Capital Gains Taxes?

Understanding capital assets is crucial for anyone interested in personal finance, investing, or real estate.

-

What is the Section 1031 Exchange?

Many commercial real estate (“CRE”) owners make the mistake of thinking Section 1031like-kind exchanges will

RESOURCES

Categorise

Recent Posts

- Unlocking Tax Savings with Special Allocations: A Guide for Individuals and Business Owners

- The Importance of Tax Planning – Strategies to Reduce Your Tax Burden

- Are You Close to Retirement? Here’s What You Need to Know

- Why Tax Planning Now Will Set You Up for Success in 2025

- Exploring Tax Programs at Wilson Hand: Maximize Deductions, Minimize Liabilities