CASH-OUT 1031

The cash-out 1031 exchange strategy not only defers taxes but also enhances financial flexibility. By reinvesting sale proceeds into a replacement property and securing a non-recourse loan against it, you tap into its equity and gain immediate cash liquidity. This approach is tailored to meet the needs of investors who seek to balance tax deferral advantages with their liquidity requirements.

This strategy allows investors to optimize their financial situation by deferring taxes while unlocking the equity in their replacement property. It provides them the crucial flexibility to pursue other investment opportunities or address financial obligations. The cash-out 1031 exchange strategy is a powerful tool for investors looking to maximize their financial resources and navigate the complexities of real estate investment with a balanced approach to tax deferral and liquidity.

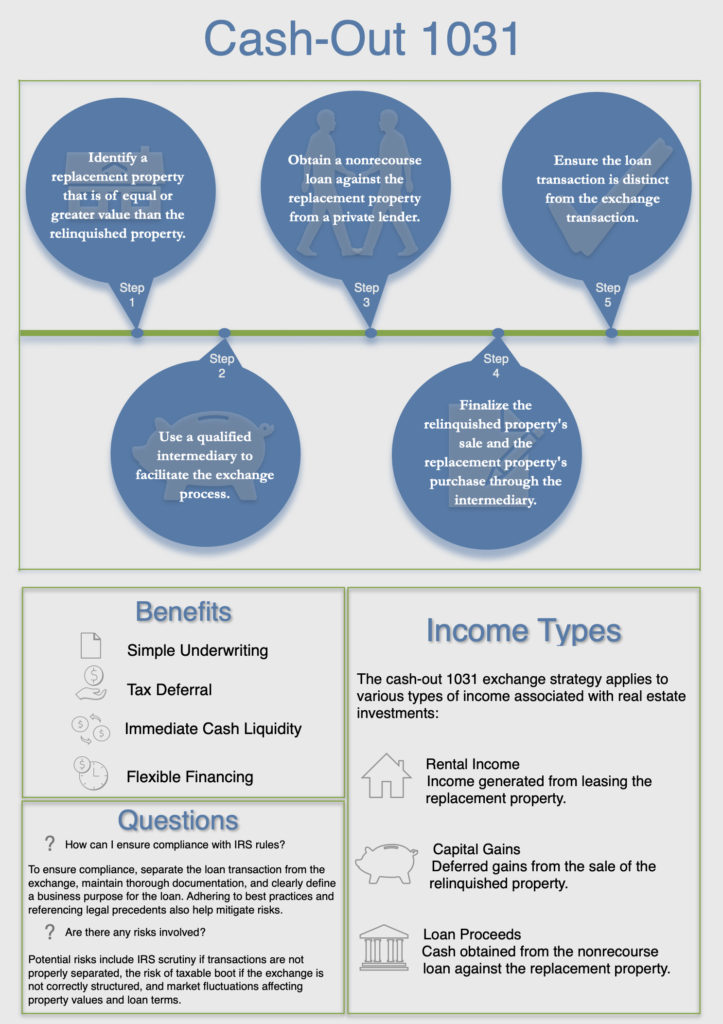

Steps

1. Identify the Replacement Property: The first step is to identify a replacement property of equal or greater value than the relinquished property. This ensures compliance with 1031 exchange regulations and avoids the creation of taxable boot.

2. Engage a Qualified Intermediary: Use a qualified intermediary to facilitate the exchange process. The intermediary holds the sale proceeds from the relinquished property and uses them to purchase the replacement property, ensuring that the client does not receive the funds constructively.

3. Secure Financing: Obtain a non-recourse loan against the replacement property from a private lender. The loan should be structured to avoid monthly repayment requirements, with interest rolled into the loan amount.

4. Complete the Exchange: Finalize the relinquished property’s sale and the replacement property’s purchase through the intermediary. This step must be completed within the IRS-mandated timelines to maintain the tax-deferral benefits.

5. Separate Transactions: Ensure the loan transaction is distinct from the exchange transaction. This separation is critical to avoid IRS scrutiny and ensure the loan is not taxable.

The Parties

Client:

The real estate investor seeking to defer taxes and obtain liquidity.

Tax Attorney:

Provides legal advice and ensures compliance with tax laws and regulations.

Qualified Intermediary:

Facilitates the 1031 exchange process by holding and transferring funds between selling the relinquished property and purchasing the replacement property.

Private Lender:

Provides the nonrecourse loan against the replacement property, offering immediate cash liquidity without personal guarantee requirements.

Income Types

The cash-out 1031 exchange strategy applies to various types of income associated with real estate investments:

Rental Income: Income generated from leasing the replacement property.

Capital Gains: Deferred gains from the sale of the relinquished property.

Loan Proceeds: Cash obtained from the nonrecourse loan against the replacement property.

Loan Considerations

Critical considerations for structuring loans within this strategy include:

Non-recourse Loan: The loan does not require a personal guarantee, reducing personal liability for the client.

No Monthly Payments: The loan structure includes rolling interest into the loan amount, eliminating the need for monthly repayments.

Development Rights: The lender may have development rights on the property, providing the borrower with options to either repay the loan and retain the property for development or keep the loan proceeds and surrender the property.

Property Breakdown

Handling different property types and their associated considerations is essential for the success of the strategy:

Real Estate Types: The strategy applies to various real estate types, including residential, commercial, and raw land properties.

Valuation: Accurate appraisal of the replacement property is critical to determine the loan eligibility and ensure the property’s value meets or exceeds the relinquished property’s value.

Depreciation: Considering depreciation rules is necessary for tax purposes, affecting the property’s taxable income and overall financial planning.

Benefits

- Immediate Cash Liquidity: Client access cash without triggering triggering taxable gains, enhancing their financial flexibility.

- enhancing their financial flexibility.

- Tax Deferral: The strategy allows for the deferral of capital gains taxes through the 1031 exchange mechanism.

- •Flexible Financing: Clients have options for refinancing and managing cash flow through the non-recourse loan structure.

- Simple Underwriting: The loan approval and funding process is streamlined, making it easier for clients to obtain financing.

Conditions

The IRS has established specific conditions that must be met to qualify for a 1031 exchange and to structure a cash-out refinance properly. Adhering to these conditions is crucial for maintaining the tax-deferred status of the transaction:

- Equal or Greater Value: The replacement property must be of equal or greater value than the relinquished property. This ensures that the transaction qualifies for full tax deferral. If the replacement property is of lesser value, the difference, known as “boot,” may be subject to capital gains tax.

- Timing Requirements: The IRS mandates strict timelines for completing a 1031 exchange. The taxpayer has 45 days from selling the relinquished property to identify potential replacement properties. The replacement property must be acquired within 180 days of the sale of the relinquished property. Adhering to these deadlines is essential to maintaining the exchange’s tax-deferred status.

Program-Related Investment (PRI) Rules

When incorporating a cash-out refinance into a 1031 exchange, ensuring that the loan proceeds are not considered taxable income is essential. To achieve this, the transactions must be clearly separate and independent:

- Independent Business Purpose: The loan obtained against the replacement property must have a clear, independent business purpose, such as funding property renovations or other investments. This helps to demonstrate that the loan is not simply a means of accessing the sale proceeds from the relinquished property.

- Separate Transactions: It is essential to maintain a clear separation between the 1031 exchange and the refinancing transaction. The refinancing should occur after the exchange is completed to avoid any appearance of tax avoidance. Proper documentation and a clear timeline of events are crucial to substantiate the independence of these transactions.

Tax Implications

Understanding the tax implications of the strategy is crucial for maximizing benefits and ensuring compliance:

- Non-Taxable Loan Proceeds: Properly structured, the proceeds from a non-recourse loan against the replacement property are not considered taxable income. This allows the taxpayer to access liquidity without triggering a taxable event. Ensuring the loan is independent and serves a legitimate business purpose is key to maintaining this non-taxable status.

- Avoiding Boot: “Boot” refers to any cash or non-like-kind property received in a 1031 exchange subject to capital gains tax. Proper structuring of the transaction to avoid boot is critical. This includes ensuring that the replacement property is of equal or greater value and that any loan proceeds are obtained independently of the exchange.

Compliance

Maintaining compliance with IRS regulations is essential to avoid penalties and ensure the strategy’s benefits:

- Documentation: Thorough documentation is necessary to support the independent nature of the exchange and the loan transactions. This includes records of the sale and purchase agreements, loan documents, and a clear timeline of events.

- Legal Precedents: Understanding relevant legal cases and IRS rulings, such as Garcia vs. Comm. and PLR 200131014, provides valuable insights into the IRS’s positions on these transactions. These precedents help to inform best practices and ensure compliance.

Best Practices for Maintaining Compliance

- Work with Qualified Professionals: Engaging experienced tax attorneys, qualified intermediaries, and private lenders is crucial for navigating the complexities of 1031 exchanges and cash-out refinancing. These professionals provide valuable guidance and ensure all transactions are properly structured and documented.

- Clear Business Purpose: It is essential to clearly define the business purpose for obtaining the loan against the replacement property. This purpose should be documented and aligned with the taxpayer’s investment strategy.

- Timing and Sequencing: Carefully plan the timing and sequencing of the exchange and refinancing transactions. Ensure the loan is obtained after completing the exchange and all IRS deadlines are met.

Maintain comprehensive records of all transactions, including purchase and sale agreements, loan documents, and communications with all parties involved. This documentation is essential for substantiating the independent nature of the transactions and demonstrating compliance with IRS regulations.

By understanding and adhering to the relevant tax codes and regulations, clients maximize the benefits of the cash-out 1031 exchange strategy while ensuring compliance with IRS guidelines. This thorough approach minimizes risks and enhances the strategy’s financial advantages.

Conclusion

The cash-out 1031 exchange strategy offers real estate investors a powerful tool to achieve tax deferral and immediate liquidity. By carefully structuring transactions and adhering to IRS guidelines, clients maximize their financial benefits while minimizing tax liabilities. This white paper is a comprehensive guide to understanding and implementing this innovative strategy, ensuring clients are well-equipped to make informed decisions and achieve their financial goals.